Funding your creative ambitionsWITH DreamCreative

BY

Create with Confidence

Did you know that arts and cultural production make up 4.4% of the U.S. economy? Creative businesses are vital pillars of our communities, enriching our cultural tapestry, stimulating economic growth, and pushing the boundaries of innovation. Powered by Etsy's Uplift Fund and DreamSpring, DreamCreative is dedicated to offering personalized funding solutions and complementary business education crafted specifically for creatives.

What Our Clients Are Saying

When Shirley needed sewing equipment and supplies, a friend recommended DreamSpring. In the years since her first startup loan, Shirley has received additional funding and continues to grow her small business. Her work highlights Native American culture through clothing.

Shirley Pino

Owner of RedWing Collections in Santa Ana Pueblo, New Mexico

"I had many sleepless nights, vulnerable moments and emotional phone calls. I'm thankful that the DreamSpring community gave me the glimmer of hope I needed to keep our staff stable for the next few months."

Kristelle Siarza Moon

Owner of Siarza Social Digital in Albuquerque, New Mexico

Rhett received a DreamSpring loan to help pay for a build-out of the raw space that would become Gallery Hózhó and hire two employees. Long term, he says, the loan has achieved so much more. “That loan is one of the main reasons that the gallery is what it is now, representing about 20 indigenous, non-indigenous, and Latinx artists, and employing four people.”

Rhett Lynch

Owner of Gallery Hózhó in Albuquerque, New Mexico

“I have always been a firm believer that you have to take extraordinary action to achieve extraordinary results, and this one has definitely paid off,” says Misti, owner of Sea Song Designs. “I’ve been living in gratitude for that every day.”

Misti Bernard

Owner of Sea Song Designs in Tampa Bay, Florida

A PPP loan from DreamSpring kept Jeremy, a Kansas City custom welder, on his feet and helped him provide for his family during the pandemic. Today, he’s expanded Jay FabWerks to include milling and furniture.

Jeremy Lockett

Owner of Jay FabWerks in Kansas City, Missouri

Approached to be part of a downtown Reno revitalization project, Adam and Ashley Sayre were delighted to discover they were approved for a DreamSpring loan that enabled a quick turnaround in obtaining a storefront for Tahoe Nevada Love.

Adam & Ashley Sayre

Owners of Tahoe Nevada Love in Reno, Nevada

Talena Acon received a flexible line of credit from DreamSpring to fund her new ventures for her music administration company.

Talena Acon

Founder of Indie Is The New Major in Kansas City, Kansas

Navy veteran Brittney Martinez qualified for a small business loan from DreamSpring that helped her bring her dream of a home staging business to fruition.

Brittney Martinez

Owner of Exenel 2.0 in Albuquerque, New Mexico

Kat Blamey of Ametrine Collective used a DreamSpring small business loan to save her hair salon in Denver, Colorado, from closing after facing an automobile accident and pandemic lockdowns.

Kat Blamey

Owner of Ametrine Collective in Denver, Colorado

Angela Sham of Royale Ballet Dance Academy in Dallas, Texas, used a DreamSpring small business loan to grow her dance studio.

Angela Sham

Owner of Royale Ballet Dance Academy in Dallas, Texas

Lee Francis IV of Native Realities, based in Albuquerque, New Mexico, used a DreamSpring small business loan to open the only Native comic shop in the world.

Lee Francis IV

Owner of Native Realities in Albuquerque, New Mexico

Debbie Kovesdy of GenTech Support, based in Phoenix, Arizona, first came to DreamSpring for a microloan to bring her tech support small business to life.

Debbie Kovesdy

Owner of Generation Tech Support in Phoenix, Arizona

Santa Fe-based nonprofit Southwestern Association for Indian Arts (SWAIA) used a DreamSpring loan to provide web development support to their 1,000+ members during the pandemic, generating more than $500,000 in online sales to Native artists, all while retaining SWAIA’s full-time staff.

Southwestern Association for Indian Arts (SWAIA)

Indigenous-Led Nonprofit

Johnny Mac Howell of True Grit Tattoo, based in Albuquerque, New Mexico, used his DreamSpring loan to follow his dreams to own and operate his own tattoo studio.

Johnny Mac Howell

Owner of True Grit Tattoo in Albuquerque, New Mexico

Jackie and Jeff Shope, owners of PhotoFunBooth based in Tucson, Arizona, used a DreamSpring loan to expand their event photo booth company into Phoenix and beyond.

Jackie and Jeff Shope

Owners of PhotoFunBooth in Tucson, Arizona

Heidi Wagner, owner of Heidi Wagner Photography based in Boulder, Colorado, used a DreamSpring loan to fund an engaging art series, the Passions Project.

Heidi Wagner

Owner of Heidi Wagner Photography in Boulder, Colorado

Rhoda Johnson of Rhoda Design Group, based in Aurora, Colorado, used her DreamSpring loan to pivot her cosmetics and beauty consulting business during the pandemic.

Rhoda Johnson

Owner of Rhoda Design Group in Aurora, Colorado

James Junes of James Junes Productions based in Farmington, New Mexico, used a DreamSpring loan to rebuild his website and purchase marketing materials.

James Junes

Owner of James Junes Productions in Farmington, New Mexico

Akil Cooper of Cornerstone Visions LLC based in Kansas City, Missouri, used a DreamSpring loan to purchase equipment for his custom signage and printing business.

Akil Cooper

Owner of Cornerstone Visions LLC in Kansas City, Missouri

Tom and Karen Cybull of Patti Ann's Flowers based in Frisco, Texas, used a DreamSpring loan to expand their flower shop business and keep a hometown staple in full bloom.

Tom and Karen Cybull

Owners of Patti Ann’s Flowers in Frisco, Texas

Joseph Manuel Alvelo of My Southern Exposure in Coral Springs, Florida, used a microloan from DreamSpring to serve other small businesses in his community.

Joseph Manuel Alvelo

Owner of My Southern Exposure in Coral Springs, Florida

Thanks to funding from two DreamSpring loans, Heather Weinberger of Heather Weinberger Art in Las Vegas, Nevada, grew her small art studio into a colorful and thriving small business.

Heather Weinberger

Owner of Heather Weinberger Art in Las Vegas, Nevada

Taylor Anderson of Provanity Cosmetics in Golden, CO used a DreamSpring loan & participated in the Tory Burch Capital Program to grow her clean makeup brand.

Taylor Anderson

Owner of Provanity Cosmetics in Golden, Colorado

Margo Jordan of Enrichly in Houston, TX used a DreamSpring loan to grow her school-aged educational & gamified self-esteem digital platform.

Margo Jordan

Owner of Enrichly in Houston, Texas

Goldie Garcia is a comic and artist located in Albuquerque, New Mexico, who has used multiple loans from DreamSpring to support her entrepreneurial endeavors.

Goldie Garcia

Comic and artist in Albuquerque, New Mexico

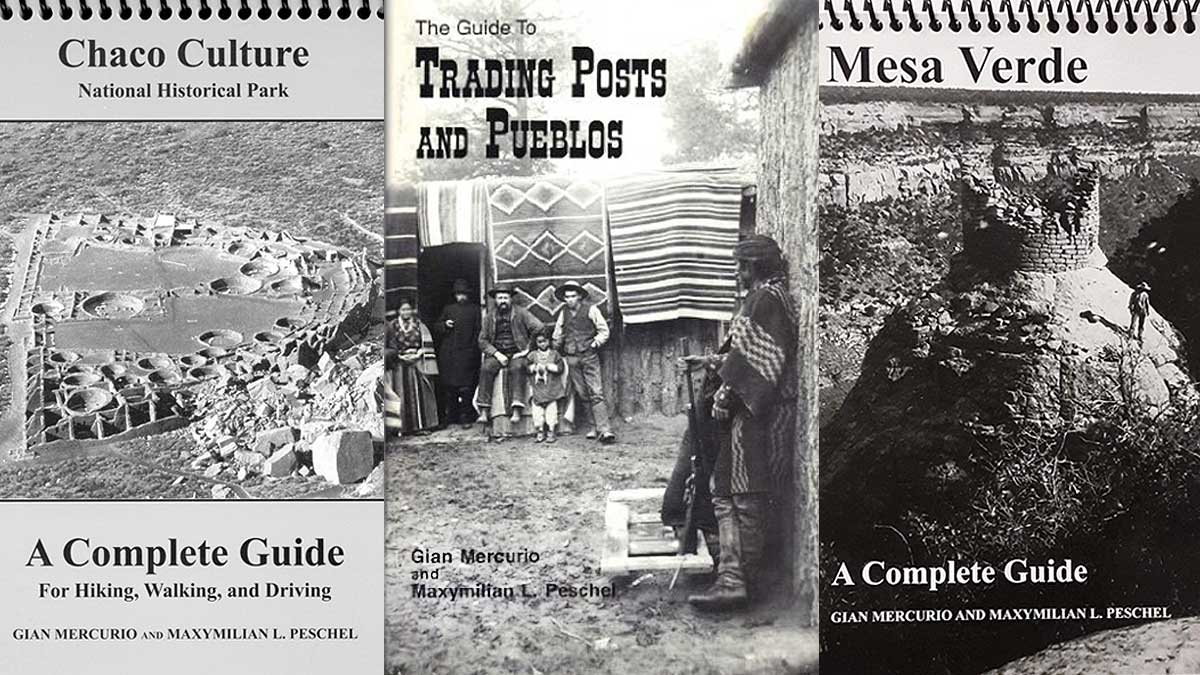

Gian Mercurio of Lonewolf Publishing in Cortez, Colorado, used multiple DreamSpring loans that help sustain her publishing business during the pandemic.

Gian Mercurio

Owner of Lonewolf Publishing in Cortez, Colorado

Mark Diaz Truman of Magpie Games in Albuquerque, New Mexico, used a Small Business Administration (SBA) loan from DreamSpring to build a legacy in the tabletop gaming industry.

Mark Diaz Truman

CEO and Co-Owner of Magpie Games in Albuquerque, New Mexico

Steven CW Taylor of Ubuntu Fine Art in Philadelphia, Pennsylvania, used a DreamSpring loan to grow his multipurpose high-end art gallery.

Steven CW Taylor

Owner of Ubuntu Fine Art in Philadelphia, Pennsylvania

Rosemary Lonewolf of Santa Clara Pueblo, New Mexico, used DreamSpring capital for a new studio space and to fill in the pay gaps between public art commissions.

Rosemary Lonewolf

Artist in Santa Clara Pueblo, New Mexico

Sulena Dyson-Mascot of Keys to the Culture in Canton, Michigan, used a DreamSpring loan to expand her waist bead and spiritual wellness studio.

Sulena Dyson-Mascot

Owner of Keys to the Culture in Canton, Michigan

Hannah Brock of The Fold Quilts in Colorado Springs, Colorado, used a DreamSpring loan to launch her sewing business and share her passion for quilting.

Hannah Brock

Owner of The Fold Quilts in Colorado Springs, Colorado

Alfonso Luna is a jeweler in Carlsbad, New Mexico, and used multiple DreamSpring loans to level up his custom jewelry craft.

Alfonso Luna

Jeweler in Carlsbad, New Mexico

Laken Arneson of Isadorra in Bellevue, Washington, used a DreamSpring loan to purchase new equipment and build inventory for her soy candle and personal care business.

Laken Arneson

Owner of Isadorra in Bellevue, Washington

Frequently Asked Questions

A creative business is any enterprise that centers creativity at the core of its business model and operates within the creative economy subgroups, including: crafts, film and media, music, fashion, museums, galleries, architecture, advertising, literary and publishing, performing arts, visual arts and design, and heritage.

Check out our Application Readiness page to learn more about qualifying. You can apply online any time!

Loans and lines of credit can be used for any business-related expenses used to start or grow your creative business — including purchasing equipment, buying inventory and supplies, operational expenses related to a project, and more!